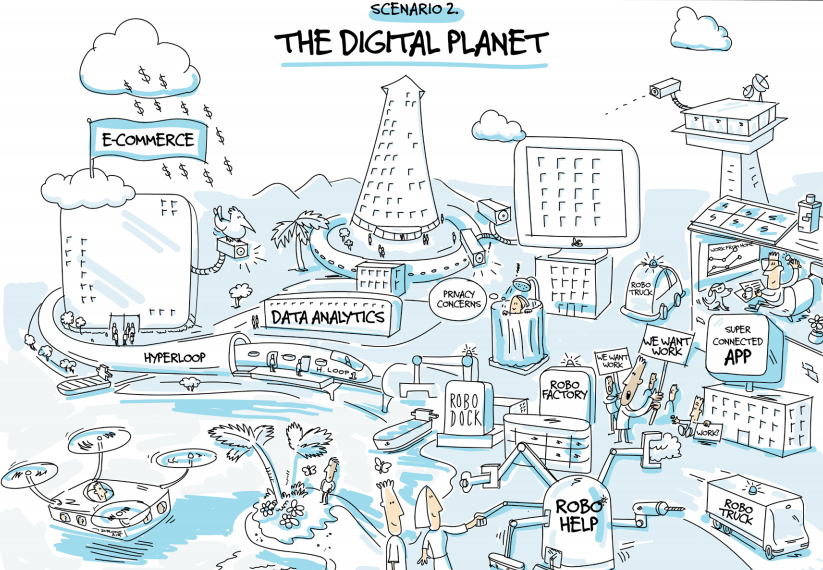

Imagine a world transformed by technology where every facet of life is touched by data, analytics and robotics. Technological innovation is rampant, controlled by large companies that have steadily reshaped the infrastructure industry

- Geopolitical context (multilateral)—Broad-based geopolitical cooperation deepens economic, financial and social connections across countries, with the private sector taking over some of the traditional roles of national governments. The infrastructure industry is led by the private sector with the state stepping back to play a light-touch regulatory role.

- Pace of climate change (managed)—Collective responses to climate change are well established with clear adaptation and mitigation actions in place. A combination of global cooperation and technological progress revolutionise the infrastructure industry’s responsiveness to climate change, affecting the way services are provided to consumers, as well as the tools, processes and materials used to develop assets.

- Technological progress (disruptive)—The infrastructure industry is revolutionised by technology firms capable of planning, delivering and operating vast networks of climate-responsive assets.

In The Digital Planet scenario, the role of government organically reduces as the private sector’s influence increases across economic, social and political facets of life.

Transformational advances in technology and digitisation enable business models that generate high returns on capital to the owners of technology.

The role of government centres on managing and arbitrating tensions within the economy and between industry and society. Specifically, governments safeguard social interests by managing the labour displacements caused by rapid technological advancement; the competitive structure of industrial markets to reduce unnatural monopolies forming; the equitable access to data pools to reduce obstacles to innovations; and the international coordination required to overcome transnational challenges, such as climate change.

Structural discontinuities in labour markets are a natural by-product of rapid and broad-based technological advancement. Highskilled employment (particularly data science, engineering and robotics jobs) and automation have fundamentally displaced more technical crafts and lower-skilled manual occupations.

Wealth distribution becomes increasingly skewed to a smaller number of people in high-value, highly skilled jobs. Governments increasingly focus on managing the labour market to ensure sufficient investments are made into training and education to provide citizens with the opportunity to participate in the modern, technologically-driven economy.

With technological innovation hard-wired into the fabric of global society, and barriers to entry low with free access to data, entrepreneurs consistently bring products and service to the market trying to displace incumbent firms. Large incumbent firms buy out successful start-ups to maintain their market position in the face of fierce competition from other established firms. But this is a continual competitive threat that fosters technological innovation. In emerging markets, the situation is different.

A reliance on foreign technology (and technology providers), the lack of deep pools of risk capital, and a smaller pool of graduates with the right technology skills constrain entrepreneurship. While it is less likely that positively reinforcing innovation systems evolve in constrain emerging markets, there may be a higher potential for ‘leapfrog’ innovations.

Technological progress is disruptive in The Digital Planet scenario. Advances in material science, computer science, data science and robotics power a technological revolution that disrupts industrial, consumer and social markets. The digitisation of real life leads to the creation of digital twins that describe, analyse and predict consumer behaviour and real-life demand patterns enabling real-time adjustments on the supply side of product markets and network industries.

Climate change is no longer an issue warranting ‘policy space’ due to coordinated global action to reduce carbon emissions and the broad-based application of climate-smart technology and building materials.

In this scenario, the nature of the infrastructure industry changes fundamentally. Technology firms reshape the market by replacing or acquiring traditional building materials firms, builders, asset owners and operators, and service providers.

Data is the critical currency for the industry’s firms as the crucial input to the integrated and comprehensive digital twins that manage asset networks from planning, through construction and operations. The availability of personal data, combined with relatively light-touch privacy regulation, have transformed the user experience across asset classes, enabling deeply personalised services.

READ MORE: Infrastructure Futures scenario one – Conflicted Planet

Dominance of private companies

Private sector participation (and complete ownership) is the dominant vehicle of asset delivery and management. Technology and the insights available from advanced analytics fundamentally alter the industry’s economics by lowering the cost base; boosting construction productivity; raising the revenue potential of providing infrastructure-linked services; and broadening opportunities for data monetisation.

Technology companies, in particular, begin to play a leading role in the design and delivery of infrastructure, and control data pools and interfaces. This leads to not only a diversity of new services, but also to an increasingly dominant position for technology companies in the infrastructure industry. Technology players integrate planning, design, construction, and maintenance to control the data and systems used on their projects. Firms outside the emerging common data systems are disadvantaged, because they cannot process data from upstream activities, and the data they produce is less valuable for downstream activities.

Independent contractors and pure operations-and-maintenance companies are most at risk because much of their work is now automated, and they increasingly depend on data from partnerships with design and engineering firms. They are forced to increase integration and collaboration across the value chain, or risk failure.

The dominance of the technology companies has displaced the traditional financial industry. Investment shifts away from physical assets and toward technology that supports step changes in asset productivity, for example the building of advanced traffic management systems that receive much greater throughput on existing transport networks. The industry becomes less capital intensive, there is a surplus of available capital and the role of independent capital providers becomes less important.

Large investment houses reduce in size and the investment industry becomes more fragmented with large firms competing with the family offices of the inventors, patent-holders, and founders of the fundamental technology architecture to fund the next technology innovation. Infrastructure investments have become routine corporate functions, rather than a niche asset class in the private markets.

Infrastructure asset demand shifts

In this technology-dominated scenario, the physical world is complemented by a rich virtual world offering immersive, productive and affordable platforms to optimise physical systems. As a result, people can travel further, more easily. The value of proximity to major economic centres reduces, leading to fundamental changes in land markets, urban design, transport networks and telecommunications requirements.

Demand is now intensely local, reshaping transport markets with significant reductions in the capacity and coverage of road networks and retrenchment of rail capacity. These traditional transport modes are replaced by affordable autonomous, shareable and electric vehicles providing last-mile intra-urban solutions.

Energy requirements in The Digital Planet scenario are significant. However, technological breakthroughs in renewable power generation, smart grid management and storage enable countries to meet the demands of consumers and industry sustainably.

Improvements in the efficiency with which industrial and consumer machines use power has also improved, lowering total energy demand systematically. Global cooperation leads to the diffusion of these energy-producing and efficiency-enhancing technologies across countries, including between emerging and mature markets.

With the rapid pace of technology development and economic reliance on data, this scenario sees significant evolution in telecommunications and data infrastructure. There is large-scale investment in global networks to underpin global communications. Data centres are critical nodes in commercial infrastructure networks. Their physical security becomes a more acute issue given the disruptive impact of any data breaches.

InfraTech

InfraTech becomes the dominant theme, with firms looking to replace manual activity with data-driven solutions at all steps of the infrastructure value chain. Technology products replace traditional manual jobs and trades (see next section for labour market implications). The human element is, however, not fully replaced as highly skilled technical experts in data science, robotics, AI, and materials science oversee the sophisticated InfraTech networks.

The advanced data and analytics capabilities within the InfraTech ecosystem enable agile and highly detailed real-time mapping, analysing and predicting of network performance. Advanced AI-based systems are used to forecast network demand in the development and planning of every infrastructure asset.

Predictive modelling is used to forecast potential consumer interactions across the asset, based on detailed datasets tracking consumer purchases, movements and habits, and enabling firms to maximise opportunities to cross-sell products (or to monetise the insight from the predictive model). These models, additionally, inform future network investments whose design, construction and operation are governed by sophisticated eight-dimensional (8D) building information models (BIM).

In this scenario, the way assets are built is fundamentally different, resulting in productivity gains, ability to deliver on-budget, and speed. These 8D BIM are the nervous system of the construction phase by fully integrating data across the full asset life cycle: object data (3D); scheduling (4D); operating and capital expenditures (5D); sustainability (6D); social inclusiveness (7D); and operation and maintenance (8D). While the core construction activities are handled by autonomous robots and equipment, human workers supervise projects and manage the real-time building materials inventory systems.

Technology also boosts transparency during the procurement process, with bid models automatically predicting outturn prices using vast datasets of final prices from previous procurements (or asset deliveries). The universality and accuracy of the systems encourage firms to continually innovate and deliver quickly, below budget and on-spec since the blockchain-powered procurement systems are ubiquitous. Moreover, the transparency afforded by these advanced technologies promote scrutiny by stakeholders.

The operations and maintenance (O&M) functions of assets – be they economic, social or civic assets – are largely commoditised.

Sensors built into an asset during construction stream information into the asset’s BIM to guide facility management activities. While the 8D models have internalised most O&M functions, specialised firms exist to create and manage digital twins that optimise asset operations and predict potential maintenance activities ahead of the 8D BIM. Moreover, industrial robotics firms maintain onsite robots.

Workforce dislocation

In The Digital Planet scenario, technology permeates every aspect of life. The impact is felt acutely in the labour markets servicing the infrastructure industry where labour is, largely, displaced by InfraTech, which aligns with current projections that by 2050 more than 40% of today’s jobs could be obsolete, and hundreds of millions of jobs lost to automation.

While the role of government is reduced in The Digital Planet scenario, public policy initiatives capable of re-skilling labour forces are paramount. This is essential to ensuring that with seismic gains in productivity, speed, consumerisation and quality, the infrastructure industries support more than just an elite workforce.

The workers requiring support from the state do not have a universal background, but are rather impacted differentially based on market (emerging versus mature), sector, age group, gender, educational level, and socio-economic background.

The interactions between labour, private firms and government are particularly fractious in emerging markets. In nations with less entrenched norms toward equitable distribution of opportunity, decision-making and wealth, the interactions lead to extractive institutional structures, largely favouring foreign technology firms and their corporate tributaries in offshore markets. Where such norms are more established, the relationship may be less extractive as the incumbent firms will be required to support local employment.

The political and market dominance of the private sector raises the prospect of base erosion and profit shifting (BEPS)14 in this scenario, especially in emerging markets. Governments are not able to enforce taxation legislation (or restrain private lobbies from influencing sympathetic legislative amendments) enabling the dominant firms to privatise value creation in the economy. This situation is likely to be exacerbated in emerging nations.

This scenario has been taken from the Global Infrastructure Hub’s Infrastructure Futures report. The scenarios offer deliberately extreme, yet plausible, versions of the future. They are not predictions, but are instead designed to prompt debate and encourage members of the infrastructure community to investigate the potential impacts and implications of these scenarios, and take action to ensure their strategies and plans are resilient to the full range of possible developments.

Keep an eye out for Scenario Three coming next week.