New Zealand may be committed to major infrastructure projects such as Auckland’s light rail but Australia’s public infrastructure investment is set to peak, a leading think tank predicts

The Australian economy will require new drivers to support employment and wages growth into the future, says BIS Oxford Economics in a recent article in The Urban Developer.

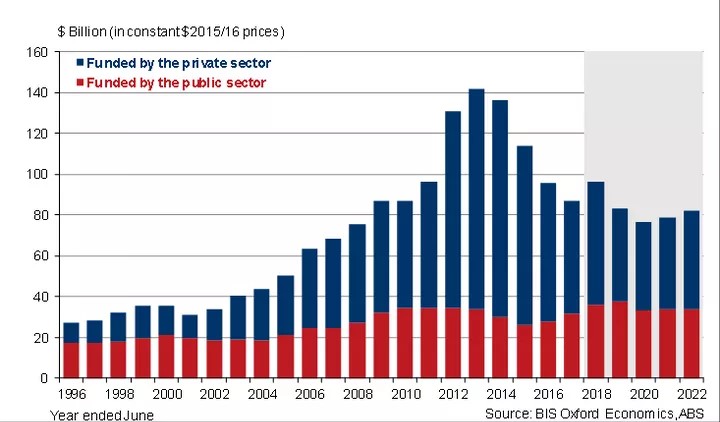

Total measured work in Australia’s largest building and construction sub-sector is estimated to rise 10% to $96 billion in 2017-18 – thanks to both rising public infrastructure investment and a renewed burst of LNG activity, according to BIS’ Engineering Construction in Australia 2018-2032 report.

The recent federal budget announcement will see an extra $24.5 billion worth of transport improvements as part of the government’s $75 billion ten-year infrastructure plan, focused on tax relief, business investment and of course, big infrastructure commitments.

BIS Oxford Economics associate director of construction, maintenance and mining Adrian Hart says publicly-funded engineering construction rose 12% (+ $4.5 billion) in 2017.

“And over 2018-19 activity will be 40% higher than the trough in 2014-15,” Hart observes.

“Driven by a range of new projects across transport as well as the rollout of the NBN, higher public infrastructure investment has helped offset the drag from the bust in resources investment – and has been a key driver of growth and employment in the national economy.

“The problem is we are fast approaching the crest of the public investment ‘wave’ – meaning the Australian economy will require new drivers to support growth in employment and incomes into the future.”

It’s anticipated that engineering construction activity will dive across 2018-19 as publicly- funded works peak and privately-funded works decline.

“An $18 billion crunch in measured oil and gas construction is the main reason behind the fall in activity in 2018/19 – and most of this represents imported LNG modules with little impact on the local construction industry,” Hart notes.

Major public sector funded transport projects > $2 billion

New South Wales is expected to outshine Western Australia as the nation’s largest engineering construction market in 2018/19, a title it last held in 2004/05.

“While NSW and Victoria will continue to perform well, activity is picking up in Queensland and South Australia – the question is whether it can be sustained,” Hart says.

It’s a grim forecast for WA. Much of the decline from 2018/19 is due to the completion of import-intensive LNG projects.

“Excluding oil and gas construction, engineering construction activity in Western Australia is forecast to rise from around $9.7 billion in 2017/18 to between $11-12 billion per annum over the subsequent four years, supported by the recent additional Federal Government infrastructure funding and a mild recovery in mining investment.”

Engineering work done by state, $bn, 2015-16 prices