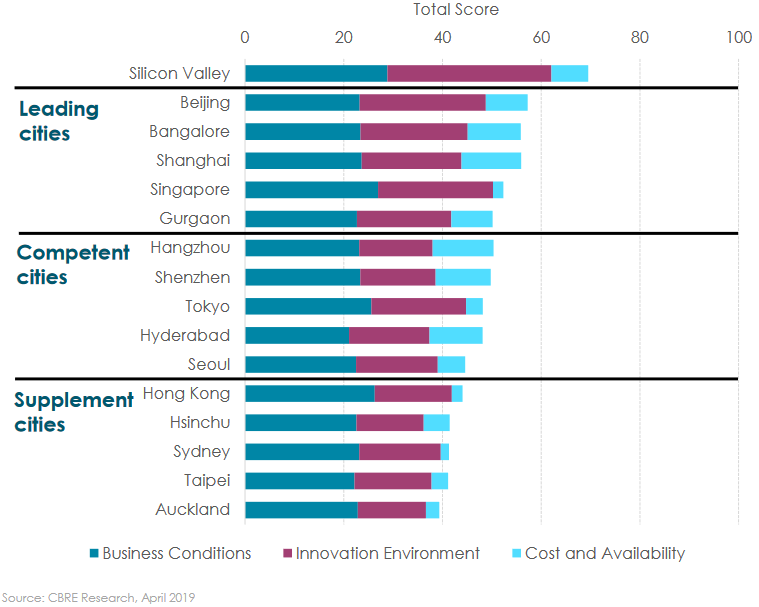

CBRE conducted a study of AsiaPacific’s leading tech cities and found that unlike Silicon Valley, which provides a strong well-rounded environment for tech sector development and growth, individual cities in the AsiaPacific possess distinct strengths and weaknesses

The study took place between January – March 2019 and considers more than 20 factors under three major criteria – business conditions, innovation environment, and cost and availability – then assigns each city with a score out of 100 and gives them an overall rank.

Business conditions (40% weighting) refers to the ease of doing business. Factors considered include government policy, availability of funding and market size and competition.

Innovation environment (40% weighting) includes the number and scale of start-ups, the quality of education and size of the talent pool, and public and private investment in research and development (R&D).

Cost and availability (20% weighting) are assessed according to occupancy and labour costs for a software engineer along with the availability of office buildings and tech parks.

Leading cities include Beijing, Bangalore, Shanghai, Singapore and Gurgaon

These cities score highly in terms of business conditions and innovation environment, as well as providing costs and availability that are supportive for business growth.

Competent cities are Seoul, Tokyo, Hangzhou, Shenzhen and Hyderabad

These cities already host tech industry sub-sectors and demonstrate solid performance across most categories.

Supplement cities are Hong Kong, Sydney, Hsinchu, Taipei and Auckland

These cities all rate favourably on certain important aspects.

These findings reflect the multi-nodal approach adopted by tech firms in Asia Pacific, which tend to select locations according to their suitability for certain business functions and units.

Tier II cities in India and China are suitable for tech firms seeking to engage in cost saving and outsourcing due their low occupancy costs, affordable labour and availability of new office supply suitable for tech firms.

R&D operations should be placed in major cities such as Beijing, Shanghai, Tokyo, Seoul and Singapore, which offer high quality universities, research institutions and a large number of start-ups.

Mature gateway cities including Hong Kong, Tokyo, Singapore and Sydney are best suited to hosting marketing and sales functions and data centres due to their business-friendly tax policies, access to funding and advanced infrastructure.

Click here to view the full report